Featured

Table of Contents

Costs are typically lower than entire life policies. With a level term policy, you can select your protection quantity and the plan length.

And you can't cash out your plan during its term, so you will not obtain any monetary advantage from your previous coverage. As with other kinds of life insurance policy, the cost of a degree term plan depends on your age, insurance coverage needs, employment, way of living and health. Commonly, you'll locate extra affordable protection if you're more youthful, healthier and less dangerous to insure.

Because degree term costs stay the very same for the duration of coverage, you'll understand precisely how much you'll pay each time. Level term coverage additionally has some flexibility, allowing you to customize your plan with extra attributes.

You may have to satisfy specific conditions and credentials for your insurer to pass this cyclist. There additionally can be an age or time restriction on the insurance coverage.

Who offers flexible Level Death Benefit Term Life Insurance plans?

The survivor benefit is normally smaller sized, and insurance coverage typically lasts until your kid turns 18 or 25. This biker may be an extra cost-efficient way to aid guarantee your children are covered as bikers can typically cover several dependents at when. When your youngster ages out of this protection, it may be possible to transform the motorcyclist right into a brand-new policy.

The most common type of irreversible life insurance policy is entire life insurance policy, but it has some key differences contrasted to degree term insurance coverage. Here's a fundamental review of what to consider when comparing term vs.

Whole life entire lasts for life, while term coverage lasts protection a specific period. The costs for term life insurance coverage are usually lower than entire life insurance coverage.

Why is Best Level Term Life Insurance important?

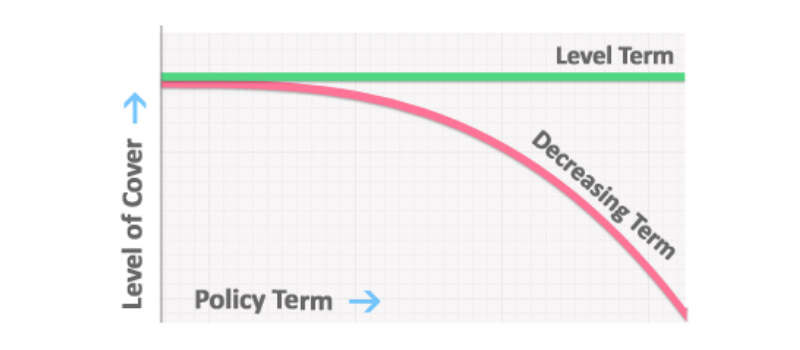

One of the main features of level term protection is that your costs and your fatality benefit do not transform. You might have protection that starts with a death benefit of $10,000, which could cover a home loan, and after that each year, the fatality advantage will decrease by a collection quantity or portion.

Due to this, it's frequently an extra economical kind of degree term insurance coverage., but it may not be adequate life insurance policy for your demands.

After selecting a plan, finish the application. For the underwriting process, you may have to offer basic personal, health, way of life and work information. Your insurance firm will establish if you are insurable and the threat you might offer to them, which is shown in your premium prices. If you're approved, sign the documentation and pay your initial premium.

You may desire to upgrade your beneficiary info if you've had any kind of substantial life modifications, such as a marital relationship, birth or divorce. Life insurance coverage can sometimes really feel complicated.

Where can I find 20-year Level Term Life Insurance?

No, level term life insurance does not have cash money worth. Some life insurance policy policies have a financial investment attribute that permits you to develop cash worth over time. Compare level term life insurance. A portion of your premium payments is alloted and can make passion gradually, which grows tax-deferred during the life of your protection

These policies are commonly substantially a lot more expensive than term insurance coverage. If you reach the end of your plan and are still active, the coverage finishes. Nonetheless, you have some options if you still want some life insurance policy coverage. You can: If you're 65 and your protection has actually run out, for example, you may wish to get a new 10-year degree term life insurance policy plan.

What is 20-year Level Term Life Insurance?

You might be able to transform your term insurance coverage right into a whole life policy that will last for the remainder of your life. Numerous kinds of degree term policies are exchangeable. That means, at the end of your coverage, you can convert some or every one of your policy to whole life coverage.

Degree term life insurance policy is a policy that lasts a set term usually between 10 and thirty years and features a level fatality benefit and level premiums that stay the same for the whole time the policy holds. This means you'll recognize exactly just how much your settlements are and when you'll have to make them, enabling you to budget appropriately.

Degree term can be a terrific alternative if you're aiming to acquire life insurance policy protection for the initial time. According to LIMRA's 2023 Insurance policy Measure Research, 30% of all adults in the U.S (Level term life insurance companies). need life insurance policy and do not have any kind of type of policy. Level term life is predictable and economical, which makes it among one of the most popular kinds of life insurance policy

A 30-year-old male with a comparable account can expect to pay $29 per month for the exact same coverage. AgeGender$250,000 coverage quantity$500,000 coverage amount$1 million coverage amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Method: Typical monthly rates are calculated for male and women non-smokers in a Preferred wellness category acquiring a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy.

What does Level Term Life Insurance Policy cover?

Prices may differ by insurance provider, term, protection amount, health and wellness course, and state. Not all policies are offered in all states. It's the most affordable form of life insurance policy for a lot of people.

It allows you to spending plan and strategy for the future. You can easily factor your life insurance policy right into your spending plan due to the fact that the premiums never change. You can prepare for the future just as easily since you recognize precisely how much cash your enjoyed ones will certainly obtain in case of your absence.

Who offers flexible Level Term Life Insurance For Seniors plans?

In these situations, you'll normally have to go via a brand-new application process to get a much better price. If you still require coverage by the time your degree term life policy nears the expiry date, you have a couple of choices.

Latest Posts

Average Final Expense Cost

Funeral And Burial Expenses

Funeral Cover For Senior Citizens