Featured

Table of Contents

That usually makes them an extra inexpensive alternative permanently insurance policy protection. Some term policies might not maintain the premium and survivor benefit the exact same in time. Annual renewable term life insurance. You do not desire to wrongly assume you're getting level term coverage and after that have your survivor benefit adjustment later on. Numerous individuals obtain life insurance coverage to assist financially secure their loved ones in situation of their unexpected death.

Or you may have the option to transform your existing term insurance coverage into a long-term policy that lasts the rest of your life. Numerous life insurance policy plans have potential advantages and drawbacks, so it's important to comprehend each prior to you determine to purchase a plan.

As long as you pay the premium, your recipients will get the survivor benefit if you die while covered. That stated, it is necessary to note that a lot of policies are contestable for two years which means insurance coverage can be rescinded on fatality, should a misrepresentation be found in the app. Policies that are not contestable typically have a rated death advantage.

How Do You Define 20-year Level Term Life Insurance?

Premiums are normally lower than entire life plans. With a degree term plan, you can choose your insurance coverage quantity and the policy size. You're not locked right into a contract for the remainder of your life. Throughout your policy, you never need to bother with the premium or survivor benefit quantities transforming.

And you can not cash out your plan during its term, so you will not receive any economic take advantage of your previous insurance coverage. Just like other sorts of life insurance policy, the price of a level term policy relies on your age, protection demands, employment, way of life and wellness. Commonly, you'll find much more budget friendly protection if you're younger, healthier and less dangerous to insure.

Because degree term premiums stay the exact same for the duration of protection, you'll know precisely just how much you'll pay each time. Degree term protection additionally has some adaptability, allowing you to personalize your policy with extra features.

What is What Is Direct Term Life Insurance? Learn the Basics?

You may have to satisfy specific conditions and certifications for your insurance firm to pass this motorcyclist. There additionally could be an age or time limitation on the coverage.

The survivor benefit is generally smaller sized, and insurance coverage typically lasts until your youngster transforms 18 or 25. This rider may be an extra cost-effective way to assist ensure your youngsters are covered as motorcyclists can usually cover numerous dependents at as soon as. Once your kid ages out of this insurance coverage, it may be feasible to convert the rider into a brand-new policy.

The most typical type of long-term life insurance coverage is entire life insurance coverage, yet it has some vital distinctions contrasted to level term insurance coverage. Right here's a fundamental summary of what to take into consideration when contrasting term vs.

What is Increasing Term Life Insurance? Discover the Facts?

Whole life entire lasts for life, while term coverage lasts insurance coverage a specific periodDetails The premiums for term life insurance are normally lower than entire life protection.

One of the major attributes of level term coverage is that your costs and your death advantage don't change. You may have protection that begins with a fatality advantage of $10,000, which could cover a home loan, and then each year, the death advantage will certainly decrease by a collection quantity or percentage.

Due to this, it's frequently a much more inexpensive type of degree term protection. You may have life insurance coverage via your employer, yet it might not suffice life insurance policy for your needs. The initial step when purchasing a plan is figuring out just how much life insurance policy you need. Consider aspects such as: Age Family members dimension and ages Employment standing Income Financial obligation Lifestyle Expected last costs A life insurance policy calculator can aid identify just how much you require to start.

What You Should Know About Term Life Insurance With Accelerated Death Benefit

After determining on a plan, finish the application. For the underwriting procedure, you may have to offer general personal, health and wellness, way of life and employment information. Your insurance provider will certainly figure out if you are insurable and the danger you may provide to them, which is shown in your premium expenses. If you're authorized, sign the documents and pay your very first costs.

Take into consideration scheduling time each year to assess your plan. You might desire to upgrade your beneficiary information if you have actually had any substantial life adjustments, such as a marital relationship, birth or separation. Life insurance can occasionally really feel complicated. You don't have to go it alone. As you explore your options, think about discussing your demands, desires and concerns with a monetary professional.

No, level term life insurance policy doesn't have money value. Some life insurance coverage policies have an investment attribute that allows you to construct cash money value over time. A part of your premium repayments is set apart and can gain interest gradually, which expands tax-deferred during the life of your protection.

You have some options if you still desire some life insurance coverage. You can: If you're 65 and your protection has run out, for instance, you may want to acquire a new 10-year degree term life insurance coverage policy.

Why You Should Consider Level Term Life Insurance Definition

You might be able to convert your term coverage right into a whole life plan that will certainly last for the remainder of your life. Lots of kinds of degree term policies are exchangeable. That means, at the end of your insurance coverage, you can transform some or all of your plan to entire life insurance coverage.

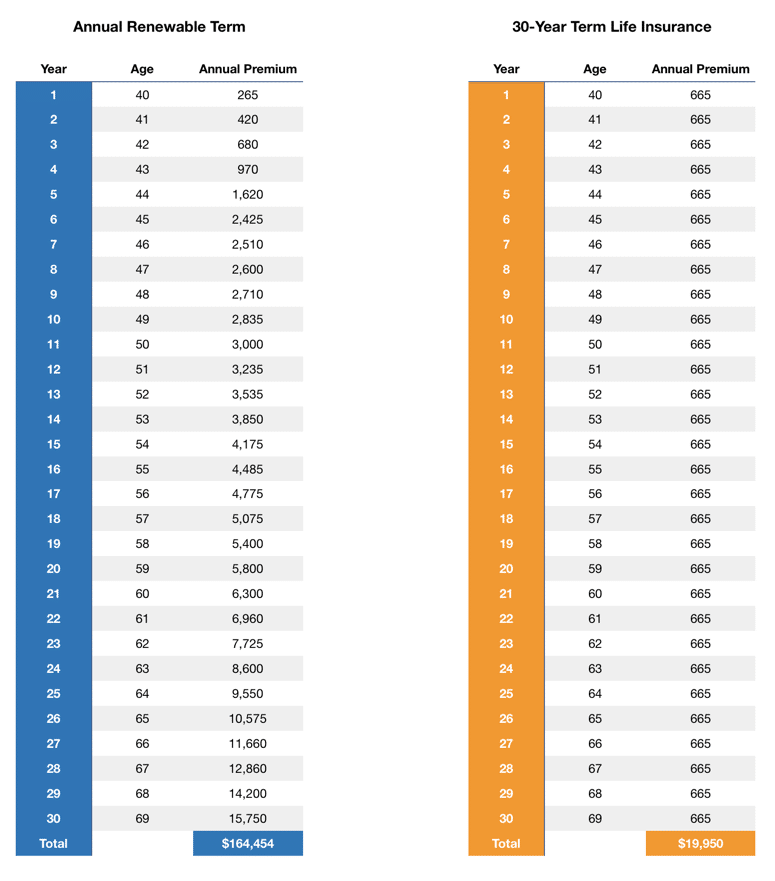

A level costs term life insurance policy strategy lets you stay with your budget while you assist secure your household. Unlike some stepped rate strategies that boosts every year with your age, this sort of term plan supplies rates that remain the very same through you pick, also as you obtain older or your wellness changes.

Find out more concerning the Life Insurance coverage alternatives readily available to you as an AICPA member (30-year level term life insurance). ___ Aon Insurance Services is the trademark name for the brokerage and program administration operations of Fondness Insurance Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Coverage Agency, Inc. (CA 0795465); in Alright, AIS Affinity Insurance Providers Inc.; in CA, Aon Affinity Insurance Coverage Services, Inc .

Latest Posts

Funeral And Burial Expenses

Funeral Cover For Senior Citizens

Final Expense Insurance Virginia