Featured

Table of Contents

Insurance provider won't pay a minor. Rather, think about leaving the cash to an estate or trust. For more comprehensive info on life insurance policy obtain a duplicate of the NAIC Life Insurance Policy Customers Overview.

The IRS puts a limitation on just how much cash can go right into life insurance premiums for the plan and how swiftly such premiums can be paid in order for the policy to preserve every one of its tax benefits. If specific restrictions are exceeded, a MEC results. MEC insurance policy holders may undergo taxes on circulations on an income-first basis, that is, to the level there is gain in their plans, along with charges on any taxed quantity if they are not age 59 1/2 or older.

Please note that impressive fundings build up interest. Revenue tax-free treatment likewise presumes the financing will ultimately be pleased from income tax-free survivor benefit profits. Fundings and withdrawals decrease the policy's cash money value and survivor benefit, might cause certain policy benefits or motorcyclists to come to be unavailable and may boost the opportunity the policy might lapse.

A customer may certify for the life insurance policy, yet not the rider. A variable universal life insurance agreement is a contract with the key function of providing a fatality benefit.

Where can I find Estate Planning?

These portfolios are very closely taken care of in order to please stated investment goals. There are fees and charges related to variable life insurance agreements, including mortality and threat charges, a front-end load, administrative fees, investment monitoring costs, surrender charges and costs for optional motorcyclists. Equitable Financial and its affiliates do not give lawful or tax recommendations.

And that's excellent, since that's exactly what the death advantage is for.

What are the benefits of whole life insurance policy? Below are some of the vital points you must recognize. One of one of the most attractive benefits of purchasing an entire life insurance policy plan is this: As long as you pay your premiums, your death advantage will certainly never run out. It is ensured to be paid no matter of when you pass away, whether that's tomorrow, in five years, 80 years or perhaps further away. Retirement planning.

Assume you don't need life insurance coverage if you do not have children? You might wish to assume again. It may seem like an unneeded expense. Yet there are lots of advantages to having life insurance policy, also if you're not sustaining a family. Below are 5 reasons why you must acquire life insurance policy.

Is there a budget-friendly Flexible Premiums option?

Funeral costs, interment expenses and clinical expenses can accumulate (Retirement planning). The last point you desire is for your loved ones to bear this added worry. Long-term life insurance policy is available in different amounts, so you can pick a survivor benefit that meets your needs. Alright, this set only applies if you have youngsters.

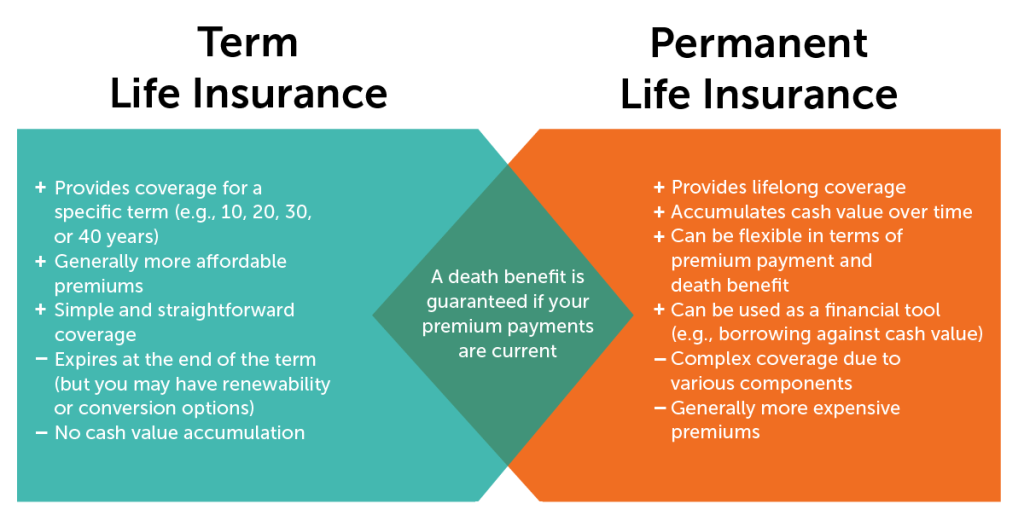

Determine whether term or permanent life insurance coverage is ideal for you. Get an estimate of how much protection you may need, and exactly how much it can set you back. Locate the best amount for your budget plan and comfort. Find your amount. As your individual scenarios adjustment (i.e., marriage, birth of a child or work promo), so will certainly your life insurance policy needs.

For the most component, there are 2 kinds of life insurance policy intends - either term or permanent plans or some mix of the 2. Life insurance providers supply numerous kinds of term plans and standard life policies in addition to "passion sensitive" items which have actually come to be a lot more widespread given that the 1980's.

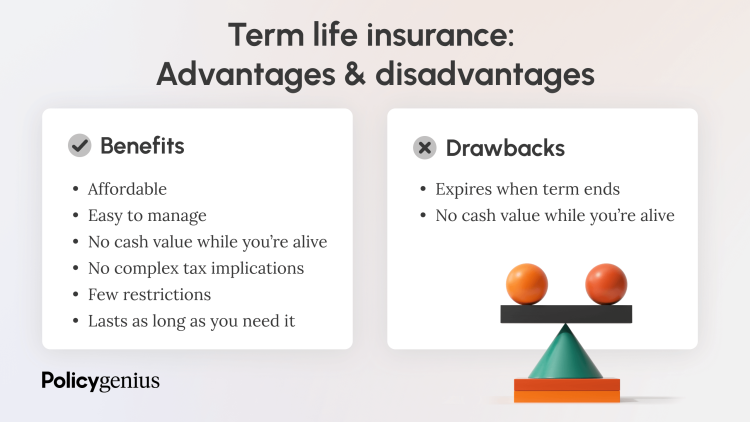

Term insurance coverage supplies protection for a given period of time. This duration could be as brief as one year or provide protection for a specific number of years such as 5, 10, two decades or to a defined age such as 80 or sometimes up to the earliest age in the life insurance coverage mortality tables.

How long does Final Expense coverage last?

Presently term insurance coverage rates are very affordable and among the lowest historically experienced. It should be kept in mind that it is a widely held idea that term insurance policy is the least costly pure life insurance protection offered. One needs to review the policy terms very carefully to determine which term life choices appropriate to meet your particular situations.

With each new term the costs is raised. The right to restore the policy without proof of insurability is a vital advantage to you. Otherwise, the risk you take is that your health and wellness may deteriorate and you may be unable to get a policy at the same rates and even whatsoever, leaving you and your recipients without insurance coverage.

The size of the conversion duration will differ depending on the type of term policy purchased. The costs price you pay on conversion is typically based on your "current attained age", which is your age on the conversion date.

Under a degree term policy the face quantity of the policy continues to be the exact same for the whole duration. With lowering term the face quantity lowers over the duration. The premium remains the very same each year. Often such plans are sold as home mortgage defense with the quantity of insurance coverage lowering as the equilibrium of the mortgage reduces.

Term Life

Generally, insurance companies have actually not had the right to change premiums after the policy is marketed. Because such policies might proceed for years, insurance companies have to use conventional mortality, rate of interest and expenditure price quotes in the premium calculation. Flexible premium insurance coverage, nevertheless, allows insurance providers to supply insurance at lower "present" costs based upon less traditional assumptions with the right to change these premiums in the future.

While term insurance is made to supply security for a specified amount of time, irreversible insurance coverage is designed to supply coverage for your entire life time. To keep the costs rate degree, the costs at the more youthful ages exceeds the real cost of defense. This extra costs builds a book (cash money worth) which assists pay for the policy in later years as the cost of defense increases over the premium.

Under some policies, premiums are needed to be spent for an established number of years. Under other plans, premiums are paid throughout the insurance policy holder's lifetime. The insurance policy company invests the excess premium bucks This kind of policy, which is in some cases called money value life insurance coverage, generates a financial savings aspect. Cash worths are important to a permanent life insurance coverage policy.

Latest Posts

Average Final Expense Cost

Funeral And Burial Expenses

Funeral Cover For Senior Citizens