Featured

Table of Contents

- – Why should I have Best Level Term Life Insurance?

- – Who offers flexible Level Term Life Insurance ...

- – How long does Tax Benefits Of Level Term Life...

- – What does a basic Best Level Term Life Insura...

- – How much does Level Term Life Insurance Prem...

- – Who offers Level Term Life Insurance Calcula...

- – What types of Level Term Life Insurance Prem...

The major differences between a term life insurance policy plan and an irreversible insurance plan (such as whole life or global life insurance policy) are the period of the policy, the accumulation of a cash money worth, and the cost. The right selection for you will certainly rely on your requirements. Here are some things to take into consideration.

People that have whole life insurance policy pay a lot more in premiums for less insurance coverage yet have the safety and security of recognizing they are protected forever. Level term life insurance coverage. Individuals that buy term life pay premiums for a prolonged duration, however they get absolutely nothing in return unless they have the bad luck to die before the term runs out

Also, substantial management charges usually cut into the price of return. This is the resource of the expression, "buy term and invest the distinction." The efficiency of irreversible insurance can be consistent and it is tax-advantaged, providing added benefits when the stock market is unpredictable. There is no one-size-fits-all response to the term versus long-term insurance coverage dispute.

The biker guarantees the right to convert an in-force term policyor one ready to expireto a permanent plan without undergoing underwriting or showing insurability. The conversion biker need to allow you to convert to any type of permanent plan the insurer uses without limitations. The main attributes of the cyclist are maintaining the original health and wellness rating of the term plan upon conversion (also if you later on have health and wellness concerns or come to be uninsurable) and making a decision when and just how much of the coverage to transform.

Why should I have Best Level Term Life Insurance?

Of training course, overall premiums will boost considerably considering that entire life insurance policy is a lot more expensive than term life insurance. The advantage is the ensured approval without a medical test. Medical conditions that establish during the term life duration can not create costs to be boosted. Nonetheless, the firm may need limited or complete underwriting if you intend to include additional bikers to the brand-new policy, such as a long-lasting care cyclist.

Term life insurance policy is a relatively cost-effective method to offer a round figure to your dependents if something takes place to you. If you are young and healthy, and you support a family, it can be a great option. Whole life insurance features considerably higher regular monthly premiums. It is implied to give insurance coverage for as lengthy as you live.

Insurance coverage business set an optimum age limit for term life insurance policies. The premium also increases with age, so a person aged 60 or 70 will certainly pay considerably even more than somebody years more youthful.

Term life is somewhat comparable to car insurance policy. It's statistically not likely that you'll require it, and the premiums are money down the drain if you don't. If the worst happens, your household will get the advantages.

Who offers flexible Level Term Life Insurance Policy plans?

A degree costs term life insurance plan allows you stick to your budget plan while you help shield your household. Unlike some tipped price plans that increases every year with your age, this kind of term plan supplies prices that remain the exact same for the period you choose, even as you age or your health and wellness changes.

Discover a lot more regarding the Life Insurance choices readily available to you as an AICPA member. ___ Aon Insurance Coverage Solutions is the trademark name for the broker agent and program administration operations of Fondness Insurance policy Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Agency, Inc. (CA 0795465); in Alright, AIS Affinity Insurance Policy Services Inc.; in CA, Aon Affinity Insurance Services, Inc.

How long does Tax Benefits Of Level Term Life Insurance coverage last?

The Strategy Representative of the AICPA Insurance Policy Trust, Aon Insurance Solutions, is not connected with Prudential. Team Insurance policy coverage is released by The Prudential Insurance Company of America, a Prudential Financial firm, Newark, NJ. 1043476-00002-00.

Essentially, there are two kinds of life insurance policy prepares - either term or permanent plans or some combination of the two. Life insurance companies provide different forms of term plans and typical life plans in addition to "passion sensitive" items which have become much more prevalent since the 1980's.

Term insurance supplies defense for a given period of time - Fixed rate term life insurance. This duration can be as short as one year or supply insurance coverage for a details variety of years such as 5, 10, 20 years or to a specified age such as 80 or in some cases approximately the earliest age in the life insurance policy mortality

What does a basic Best Level Term Life Insurance plan include?

Presently term insurance coverage prices are very competitive and amongst the cheapest traditionally seasoned. It needs to be noted that it is an extensively held belief that term insurance is the least pricey pure life insurance policy coverage offered. One needs to review the policy terms carefully to determine which term life choices appropriate to fulfill your specific situations.

With each brand-new term the premium is boosted. The right to restore the policy without evidence of insurability is a vital advantage to you. Or else, the threat you take is that your health may wear away and you may be not able to acquire a plan at the same rates or even whatsoever, leaving you and your beneficiaries without protection.

You should exercise this choice during the conversion duration. The length of the conversion period will certainly differ relying on the sort of term policy bought. If you convert within the proposed duration, you are not called for to provide any type of information about your health. The premium price you pay on conversion is normally based on your "existing attained age", which is your age on the conversion day.

How much does Level Term Life Insurance Premiums cost?

Under a degree term policy the face amount of the policy stays the same for the entire duration. With reducing term the face quantity decreases over the period. The premium stays the same annually. Commonly such policies are offered as mortgage security with the quantity of insurance lowering as the balance of the home loan lowers.

Typically, insurance firms have not had the right to transform premiums after the plan is sold. Since such policies may continue for years, insurance providers have to use conservative mortality, passion and expenditure rate estimates in the costs calculation. Adjustable costs insurance coverage, however, enables insurance firms to supply insurance at reduced "current" premiums based upon less conventional presumptions with the right to change these costs in the future.

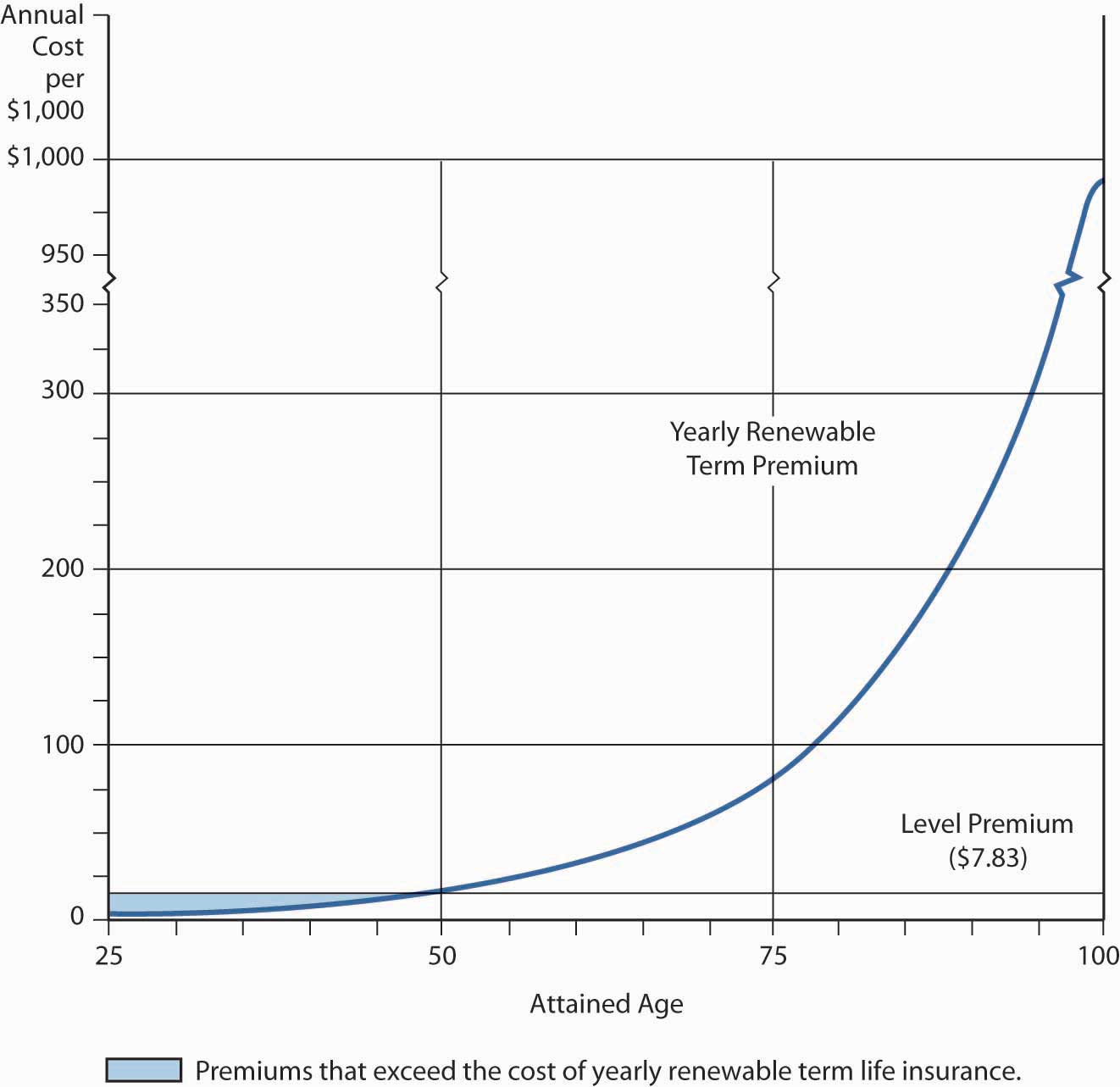

While term insurance policy is designed to supply defense for a defined period, permanent insurance policy is designed to offer protection for your entire lifetime. To keep the premium rate level, the premium at the more youthful ages exceeds the real price of defense. This extra premium builds a book (cash money worth) which assists spend for the plan in later years as the expense of security increases above the premium.

Who offers Level Term Life Insurance Calculator?

With degree term insurance coverage, the cost of the insurance coverage will certainly stay the very same (or potentially reduce if dividends are paid) over the regard to your policy, typically 10 or two decades. Unlike irreversible life insurance, which never ends as lengthy as you pay costs, a degree term life insurance coverage policy will certainly finish at some point in the future, normally at the end of the period of your level term.

As a result of this, lots of people use long-term insurance coverage as a stable monetary planning device that can serve several requirements. You may be able to transform some, or all, of your term insurance coverage during a set period, typically the very first ten years of your plan, without requiring to re-qualify for coverage even if your wellness has transformed.

What types of Level Term Life Insurance Premiums are available?

As it does, you may desire to add to your insurance protection in the future. As this happens, you may want to at some point lower your fatality advantage or take into consideration transforming your term insurance coverage to a permanent plan.

Long as you pay your costs, you can rest simple understanding that your enjoyed ones will get a fatality benefit if you die during the term. Lots of term plans permit you the ability to convert to irreversible insurance coverage without having to take another wellness examination. This can enable you to make the most of the added benefits of a permanent policy.

Table of Contents

- – Why should I have Best Level Term Life Insurance?

- – Who offers flexible Level Term Life Insurance ...

- – How long does Tax Benefits Of Level Term Life...

- – What does a basic Best Level Term Life Insura...

- – How much does Level Term Life Insurance Prem...

- – Who offers Level Term Life Insurance Calcula...

- – What types of Level Term Life Insurance Prem...

Latest Posts

Average Final Expense Cost

Funeral And Burial Expenses

Funeral Cover For Senior Citizens

More

Latest Posts

Average Final Expense Cost

Funeral And Burial Expenses

Funeral Cover For Senior Citizens